-

-

Digital Onboarding AssessmentsDigital Onboarding Assessments

-

Digital Onboarding eBookDigital Onboarding eBook

-

Digital Onboarding AssessmentsDigital Onboarding Assessments

-

Digital Onboarding eBookDigital Onboarding eBook

Client-Centric Integrated Digital Banking Solutions

-

Digital Banking AssessmentsDigital Banking Assessments

Where it all started! Accutive FinTech has been providing end-to-end lending solutions since our founding in 2009

-

Loan Origination SystemsLoan Origination Systems

-

Collections and RecoveryCollections and Recovery

Helping financial institutions start with AI and automation in an intelligent and low risk way-

Robotic Process Automation (RPA)Robotic Process Automation (RPA)

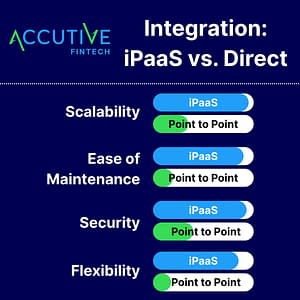

Seamless integrate anything. From MuleSoft and other iPaaS solutions to custom P2P integrations, Accutive FinTech’s team of integration experts are here to help

-

API IntegrationAPI Integration

-

iPaaS Integration AssessmentsiPaaS Integration Assessments

-

Enterprise Integration ArchitectureEnterprise Integration Architecture

-

Core System Integration ServicesCore System Integration Services

-

API Governance & ManagementAPI Governance & Management

-

Data Integration (ETL/ELT)Data Integration (ETL/ELT)

Core banking integration specialists with a team of experienced core banking architects, developers, BA and QA resources

Fraud, risk and compliance are top of mind for every financial institution. We partner with global leaders to protect your financial institution.-

AMLAML

-

KYC and IDVKYC and IDV

-

Online Fraud DetectionOnline Fraud Detection

-

-

Accutive FinTech provides a full range of development, integration, consulting, advisory and project management services.

-

Project and Program ManagementProject and Program Management

-

Consulting and AdvisoryConsulting and Advisory

-

Systems Integration (SI)Systems Integration (SI)

-

Platform Architecture and DevelopmentPlatform Architecture and Development

-

Test AutomationTest Automation

-

-

Accutive FinTech partners with industry-leading FinTech platforms to power next-generation digital and AI experiences.

-

Partner NetworkPartner Network

Accutive FinTech partners with Temenos to deliver exceptional digital onboarding, core banking and lending experiences.

-

Temenos Journey ManagerTemenos Journey Manager

-

Temenos LMSTemenos LMS

-

Temenos Transact Core BankingTemenos Transact Core Banking

Accutive FinTech is a Salesforce Consulting and Integration partner that specializes in MuleSoft for Financial Services.-

MuleSoft AssessmentsMuleSoft Assessments

-

MuleSoft RPAMuleSoft RPA

We partner with ebankIT, an innovative global digital banking platform, to implement and integrate their solutions.

-

ebankITebankIT

-

-

Lorem ipsum dolor sit amet consectetur. Proin amet fermentum

vitae dapibus curabitur purus eget nulla scelerisque.-

ArticlesArticles

-

Whitepapers + Solution BriefsWhitepapers + Solution Briefs

-

Case StudiesCase Studies

-

Press ReleasePress Release

-

VideosVideos

-

-

-

About UsAbout Us

-

Accutive Global Parent CompanyAccutive Global Parent Company

-