As the financial services landscape continues to evolve, banks and credit unions face mounting pressure to modernize their technology stack, improve customer experiences, and meet increasingly complex regulatory and security requirements. Most financial institutions are transitioning from the digital transformation stage to automating business processes, while preparing for the adoption of agentic AI. At the center of these efforts is one critical capability: system integration.

This article breaks down the differences between Point-to-Point (Direct) Integrations and iPaaS (Integration Platform as a Service) solutions, outlines the trade-offs of each, and explains why financial institutions are increasingly adopting iPaaS as their long-term integration strategy.

Direct (Point-to-Point) Integrations: The Traditional Path

Direct integrations, commonly referred to as Point-to-Point (P2P), involve the development of custom, hard-coded connections between individual systems, applications, or vendors. For financial institutions maintaining a static technology stack with a limited number of systems, this approach has historically served as the path of least resistance.

The Appeal of Direct Integration

Point-to-Point integrations were traditionally preferred by financial institutions for two primary tactical reasons:

- Tailored Logic: These integrations can be highly tailored to the institution’s specific systems, constraints, and business rules, offering developers granular control over data transmission.

- Lower Capital Expenditure (CapEx): The approach requires no platform licensing fees and minimal upfront architectural investment.

Paradoxically, these two initial advantages can actually become detriments over the medium to long term. Many financial institutions are now facing the expensive and time consuming consequences of relying on point to point integrations to connect their critical systems.

The Strategic Liability: Technical Debt and Fragility

While custom integrations are frequently favored by developers for their immediacy, the long-term implications present significant operational risks. These integrations invariably become deeply coupled with legacy systems, rendering future modernization efforts significantly more arduous.

Over time, this results in the accumulation of substantial technical debt. The ecosystem becomes fragile, reliant on “tribal knowledge”, often dependent on a small cohort of developers who understand the custom scripts. Although this may provide enhanced job security for developers, it harms the financial institution over time. Furthermore, custom integrations are rarely reusable; each new project or vendor partnership necessitates a brand-new connection.

Consequently, the customization that initially appears advantageous ultimately reduces agility. Every regulatory update or business process change requires code refactoring across multiple disparate systems. The result is an inverse value curve: lower initial costs almost invariably lead to exponentially higher long-term total cost of ownership (TCO).

Integration Platform as a Service (iPaaS): The Modern Standard

In stark contrast to the rigid, linear structure of P2P integration, Integration Platform as a Service (iPaaS) functions as an intelligent central switchboard for the enterprise. It is a cloud-based middleware solution that standardizes how applications communicate, acting as a unified hub where data flows are designed, executed, governed, and monitored.

Transitioning from P2P integrations to iPaaS can be thought of as moving from “building bridges” to “building a transportation network.” By decoupling applications from one another and connecting them solely to a central hub, institutions achieve a modular, “Hub-and-Spoke” architecture that offers three primary strategic advantages:

Decoupling and Vendor Agility

In a P2P environment, replacing a vendor is akin to performing complex surgery; the connections are deep, vital, and difficult to extract without risk. Leveraging an iPaaS enables loose coupling where applications connect to the platform, not to each other.

For a financial institution, this means if you decide to swap a Know Your Customer (KYC) provider or modernize a specific module of your Core Banking System, the change is isolated to the connector at the hub level. The downstream systems (e.g., Digital Banking, Loan Origination) remain unaffected. This modularity enables the technology stack to more easily evolve from a monolith into a flexible ecosystem of “best-of-breed” solutions.

Standardization and Reusability

iPaaS solutions utilize pre-built connectors and standardized protocols (such as REST APIs, SOAP, and JSON). Rather than writing custom code for every transaction, developers configure standard adapters that are maintained and updated by the platform provider.

This fosters high reusability. An integration built to pull member data from the Core for a marketing campaign can be reused to pull that same data for a fraud detection system. This “build once, deploy anywhere” capability eliminates the redundancy inherent in P2P coding, ensuring that the institution’s speed-to-market increases as the library of integrations grows.

Orchestration and Logic Democratization

Most modern iPaaS solutions do more than simply move data; they orchestrate complex workflows. They serve as a translation layer, converting data from legacy formats (often found in older mainframes) into modern, usable structures for cloud-native applications.

Furthermore, many enterprise iPaaS platforms, including MuleSoft Anypoint Code Builder and Boomi, offer low-code or no-code interfaces. This democratizes the integration process, allowing business analysts and even non-technical resources closest to the business problem to map data flows and design logic without relying entirely on specialized engineering resources. This alleviates IT bottlenecks and aligns technology delivery closer to business strategy.

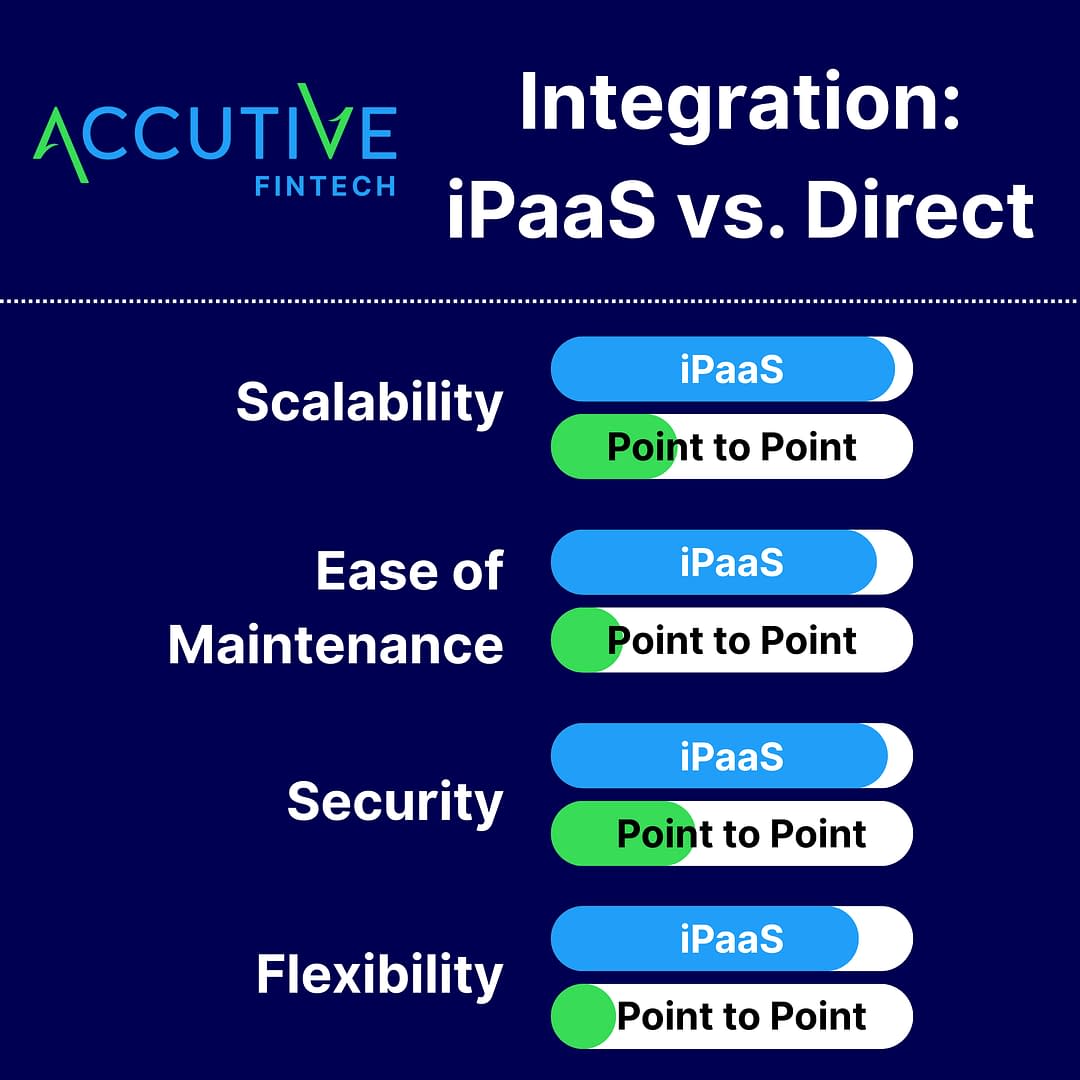

Comparing Direct P2P Integration and iPaaS

For digital leaders evaluating their integration strategy, the architectural decision extends beyond technical preferences; it creates ripples across four key dimensions of the financial enterprise. The following analysis outlines the strategic divergence between the two models.

Scalability and Vendor Agility

- Direct P2P Integration: In a Point-to-Point environment, innovation is throttled by IT bandwidth. Because integrations are hard-coded, replacing a legacy vendor requires rewriting every connection associated with that system. This creates “vendor lock-in” where institutions delay necessary upgrades simply to avoid the cost and risk of re-integration.

- iPaaS: iPaaS facilitates a “best-of-breed” technology strategy. New Fintech partnerships and applications can be integrated rapidly using standard connectors. This agility is essential for institutions seeking to deploy new digital features (e.g., Buy Now, Pay Later or instant account opening) ahead of competitors.

Security, Governance, and Compliance (GLBA/SOC2)

- Direct P2P Integration: Security logic in P2P integrations is often fragmented across dozens of individual scripts. During regulatory audits, demonstrating the lineage of sensitive member data requires a manual, forensic review of disparate codebases. This lack of visibility increases the risk of data leaks and compliance violations.

- iPaaS: iPaaS centralizes security governance. The platform provides uniform authentication protocols (such as OAuth), centralized logging, and real-time monitoring. This allows Compliance Officers to trace the exact movement of sensitive data across the enterprise instantly, drastically reducing the complexity and cost of audits.

Total Cost of Ownership (TCO)

- P2P: This model follows the “Iceberg Principle.” Direct integrations are characterized by low visible costs (implementation) but massive submerged costs (maintenance, debugging, and refactoring). As the number of systems grows, the maintenance burden scales non-linearly, eventually consuming the majority of engineering resources.

- iPaaS: While iPaaS involves higher upfront licensing fees, it delivers predictable, lower operational costs over time. The use of low-code tools allows business analysts to manage routine workflows, freeing high-cost engineering talent to focus on core product innovation rather than “keeping the lights on.”

Readiness for Agentic AI

- P2P: Custom integrations function as an AI roadblock. Artificial Intelligence requires clean, accessible, and structured data to operate. P2P architectures often trap data in silos and unstructured custom code that AI agents cannot navigate effectively.

- iPaaS: iPaaS acts as the AI prerequisite. By standardizing data models and API access, the platform creates the unified data fabric required for Generative and Agentic AI to function autonomously, securely, and accurately. Some iPaaS solutions, such as MuleSoft have built in agentic AI capabilities that can ease the transition to implementing AI capabilities.

Comparison At A Glance: P2P vs. iPaaS

| Feature | Point-to-Point (Direct) | iPaaS (Enterprise Platform) |

| Architecture | Tightly coupled, rigid | Decoupled, modular (Hub-and-Spoke) |

| Visibility | Fragmented (Opaque) | Centralized Dashboard (Transparent) |

| Maintenance | High (Custom code debt) | Low (Vendor managed connectors) |

| Security | Inconsistent per integration | Enterprise-grade standard |

| AI Readiness | Low | High |

Future-Ready Integration Architecture

For smaller financial institutions operating with a minimal toolset, Point-to-Point integration may remain a viable, cost-effective option. However, for a financial institution managing complex regulatory requirements, legacy core systems, and the demand for omnichannel member experiences, P2P integration has evolved from a tactical solution into a strategic liability for many FIs.

The shift to iPaaS is not merely an IT upgrade; it is a fundamental restructuring of how the bank operates. By adopting an iPaaS strategy, financial institutions transform integration from a technical bottleneck into a competitive advantage. It allows the institution to:

- De-risk Modernization: Incrementally migrate away from legacy cores without catastrophic service interruptions.

- Accelerate Delivery: Reduce the time-to-market for new digital products from months to weeks.

- Secure the Future: Establish the governed data foundation necessary to leverage the next wave of Agentic AI technologies.

To remain competitive in the coming decade of financial services, institutions must prioritize an integration strategy that favors long-term adaptability over short-term convenience.