Across the financial services industry, digital transformation efforts often stall because of integration challenges. Banks and credit unions often rely on complex webs of legacy systems, core banking, lending, CRM, compliance, and digital channels, that were never designed to work together. Too often, the result is a fragmented digital ecosystem where customer data is trapped in silos, manual processes create inefficiency, and new technology initiatives take months or years to deploy.

As customer and member expectations for real-time, personalized, and seamless digital experiences continue to rise, traditional integration models can no longer keep pace. Financial institutions need a more scalable, agile, and secure way to connect systems, applications, and partners across their ecosystem.

That’s where API-led connectivity comes in. It’s the modern approach to integration that allows financial institutions to unlock data, accelerate innovation, and enable composable banking, all without disrupting existing systems of record.

What Is API-Led Connectivity?

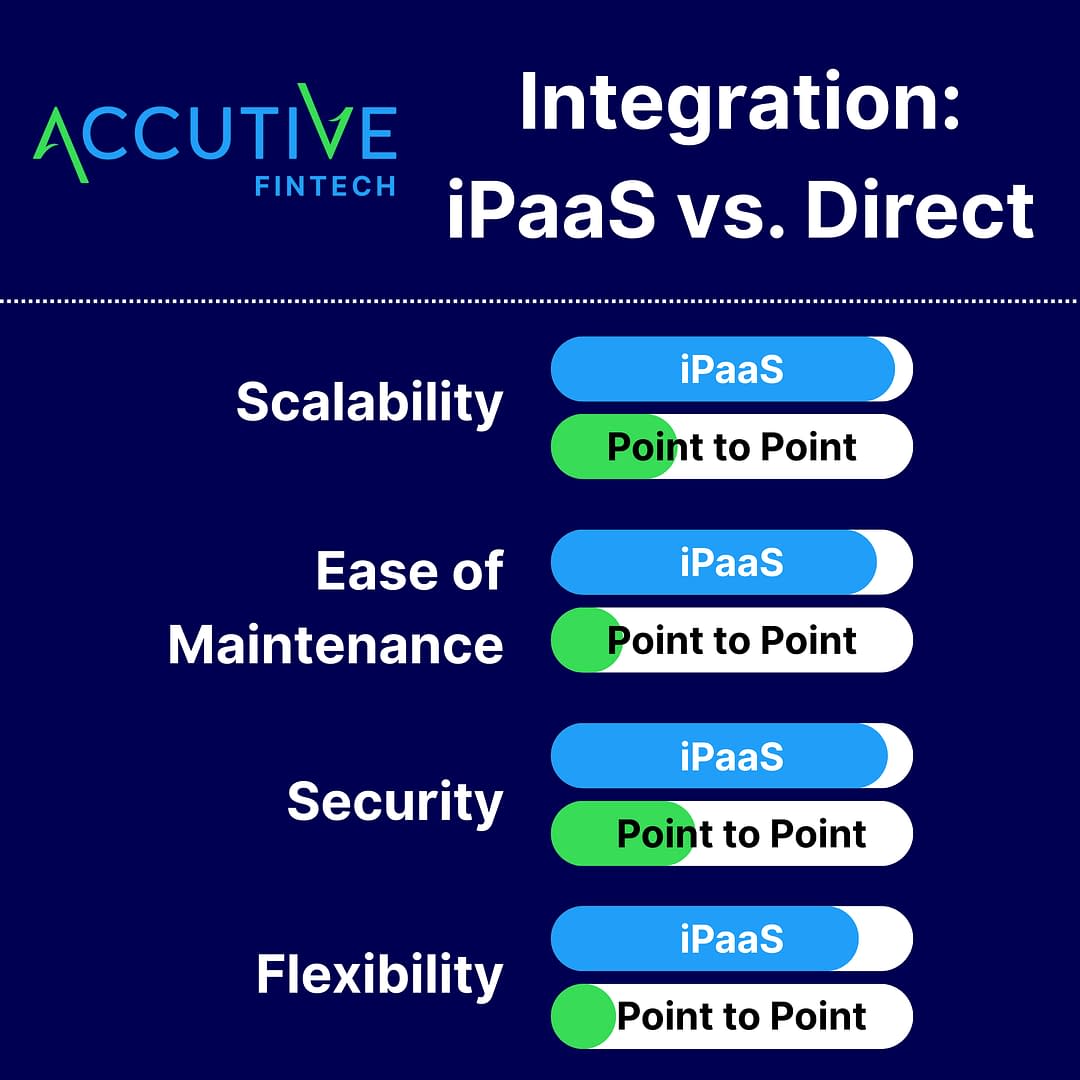

API-led connectivity is an architectural approach to enterprise integration that defines how systems, applications, and data communicate using standardized, reusable, and secure Application Programming Interfaces (APIs). Rather than treating integrations as ad-hoc point-to-point connections, API-led connectivity structures them within a layered, modular framework designed for scalability, governance, and long-term maintainability.

In a traditional integration model, systems are often linked through custom code or one-off connectors (we sometimes refer to this as “spaghetti architecture”). Each integration is tightly coupled, making even small system changes risky, time-consuming, and expensive. Over time, this creates technical debt, inhibits agility, and limits innovation.

API-led connectivity replaces that model with a service-oriented, decoupled architecture, where every system or process is exposed through a well-defined API that can be reused across multiple projects and channels. Each API serves a specific function – whether exposing data from a core banking platform, orchestrating processes between lending and onboarding systems, or powering customer-facing digital channels.

At the technical level, this approach has several critical advantages for financial institutions:

- Decouples front-end experiences from back-end systems, allowing user interfaces or partner integrations to evolve without impacting core services.

- Implements standardized communication protocols, such as RESTful APIs over HTTPS with JSON payloads, ensuring interoperability between modern and legacy systems.

- Enforces governance and security policies, such as authentication (OAuth 2.0, OpenID Connect), authorization, and rate limiting, to maintain control over who accesses data and how.

- Enables versioning and lifecycle management, allowing APIs to evolve independently while maintaining backward compatibility for existing consumers.

- Supports event-driven and real-time integration patterns through asynchronous messaging or APIs that publish and subscribe to events — ideal for banking use cases like fraud detection, transaction monitoring, or digital onboarding.

By centralizing integration logic within an API-led architecture, institutions create a governed layer of reusable building blocks that can be extended across products, lines of business, and partner ecosystems. This modularity serves as the foundation of composable banking, which is the ability to mix and match digital capabilities quickly and securely.

In essence, API-led connectivity transforms integration from a fragile, back-end maintenance task into a logical, interconnected system that enables digital agility, automation, and ecosystem expansion. For financial institutions, this means faster innovation, more reliable data flow, and the ability to adapt seamlessly as technologies, regulations, and customer expectations evolve.

MuleSoft’s Three Layers of API-Led Connectivity

At the core of MuleSoft’s API-led connectivity model is a three-tiered architecture that logically separates how data is exposed, transformed, and delivered across an organization. This design pattern enforces modularity, scalability, and reusability. These are key principles for financial institutions managing complex, multi-vendor ecosystems.

Each API layer serves a distinct purpose in the data integration lifecycle, while collectively enabling secure, governed, and efficient connectivity across the enterprise.

Layer 1: System APIs

System APIs form the foundation of an API-led architecture. They connect directly to the institution’s key systems of record, such as core banking, lending, CRM, and payment platforms, serving as secure gateways that expose critical data without compromising the underlying infrastructure.

In practice, these APIs are typically implemented using RESTful services (JSON over HTTPS) for modern platforms, while SOAP-based integrations remain common where legacy systems require them. Within financial institutions, the system APIs interact with core platforms like Fiserv DNA, Temenos Transact, Jack Henry, Symitar, or FIS, using a mix of adapters, JDBC connectors, or message queues to ensure reliable data exchange.

Security is paramount at this layer. OAuth 2.0, mutual TLS (mTLS), and fine-grained access policies, which are managed through MuleSoft’s API Manager, ensure that sensitive data is only accessible to authorized applications and users. These APIs abstract the complexity of legacy systems, which means they can be reused across multiple downstream processes, from balance inquiries and customer lookups to account validations and internal reporting.

By introducing System APIs as intermediaries, institutions can expose data and functions from the core safely and consistently, without altering the core itself. These APIs act as standardized “doors” through which modern digital applications can securely access and use the data they need. By decoupling back-end systems from front-end channels, financial institutions can modernize their digital experiences without undergoing costly and risky core conversions.

Layer 2: Process APIs

Sitting above the System layer, Process APIs act as the integration and orchestration engine for the enterprise. Their role is to unify data from multiple sources, apply business logic, and transform it into meaningful, usable information for higher layers and external systems. For example, Process APIs often merge credit decisioning data from a loan origination system with KYC and AML verification results from partners such as Alloy or Prove, creating a single, enriched customer profile. In MuleSoft, the DataWeave transformation language powers these processes, allowing data to be mapped, filtered, and enriched dynamically across diverse formats and protocols.

Process APIs frequently manage real-time and asynchronous communication, leveraging event-driven messaging frameworks such as JMS, Kafka, or AMQP to ensure resilience and scalability. They also centralize business rules, such as validation, exception handling, and retry logic, so that consistent governance and error management are applied across every integration.

By embedding orchestration logic in Process APIs, institutions can standardize workflows across business lines, minimize redundancy, and maintain a single source of truth for operational processes—ultimately improving data quality, transparency, and compliance readiness.

Layer 3: Experience APIs

At the top of the stack, Experience APIs translate orchestrated data into consumable services for specific audiences, whether that’s a digital banking user, a mobile app, an internal dashboard, or a third-party FinTech partner. This layer ensures that every interaction is context-aware, secure, and optimized for the delivery channel.

Experience APIs handle payload shaping and transformation, tailoring responses for each interface. For example, an API serving a mobile app may compress data for performance, while one serving an external FinTech partner may expose only the fields required by an Open Banking or Open Finance standard such as FDX, PSD2, or ISO 20022. MuleSoft’s API Gateway applies critical security controls at this layer, including rate limiting, throttling, and JWT-based authentication, ensuring that external consumers can safely access only what they are authorized to use.

These APIs also provide flexibility for rapid innovation. As new digital experiences are deployed—such as upgraded online account opening portals or AI-powered member service interfaces—existing Experience APIs can be reused or extended without modifying the underlying Process or System APIs. This approach reduces time to market and ensures that customer-facing innovation doesn’t require disruptive changes deeper in the stack.

Together, these Experience APIs enable consistent, omnichannel experiences that unify customer interactions across digital, mobile, and in-branch environments—helping banks and credit unions deliver seamless service while maintaining centralized control and compliance.

Why API-Led Connectivity Matters for Financial Institutions

Together, the three API layers, System, Process, and Experience, create a loosely coupled, highly reusable architecture that changes how financial institutions integrate, innovate, and operate. Each layer is designed to function independently, allowing teams to make system changes, launch new digital experiences, or onboard FinTech partners without rewriting or disrupting existing integrations.

This architecture offers several key advantages:

- Scalability: Institutions can quickly connect new systems or launch new products without adding complexity to existing integrations.

- Governance: Centralized policies for authentication, authorization, and versioning ensure compliance and control across every integration.

- Resilience: Fault isolation between layers reduces the risk of cascading failures, enhancing uptime and reliability.

- Speed: Reusable APIs and prebuilt connectors significantly reduce time to market for new initiatives.

- Innovation: By exposing core data and services securely, banks and credit unions can collaborate with FinTechs and third-party developers to deliver new experiences faster.

For IT and business leaders, this means integration is no longer a bottleneck, it becomes a strategic enabler of digital agility, automation, and composability. API-led connectivity lays the foundation for modern, data-driven banking, where institutions can continuously evolve their technology stack without the cost, disruption, and risk of large-scale system replacements.

Real-World Impact: From Static to Composable Banking

The shift to API-led connectivity is redefining how financial institutions design and deliver digital experiences. By adopting this architecture, banks and credit unions can transform fragmented, legacy-driven onboarding and servicing journeys into integrated, frictionless member and customer experiences.

Consider the example of digital onboarding, one of the most visible and impactful processes in modern banking. Traditionally, onboarding required multiple disconnected systems: a web form for data capture, a separate platform for KYC and ID verification, another for funding, and manual data re-entry into the core. Each integration point was custom-coded and difficult to maintain, resulting in long implementation cycles, inconsistent user experiences, and a high rate of abandonment.

With an API-led architecture that entire process becomes modular, reusable, and orchestrated across a unified data flow.

At the System API layer, the institution exposes secure endpoints for the core banking system, CRM, loan origination system, and digital banking platform. This unlocks customer, account, and transaction data without direct dependencies on legacy code.

At the Process API layer, these data streams are orchestrated and enriched. MuleSoft’s DataWeave engine can merge KYC and AML results from platforms like Alloy or Prove, verify funding through Plaid or Payroc, and pre-populate customer records in real time. Business rules, such as eligibility validation or document completeness checks, are applied consistently across all product lines – whether the member is opening a checking account or applying for a loan.

Finally, at the Experience API layer, the unified data is delivered to the onboarding application, mobile banking app, or CRM dashboard through a consistent and secure interface. This ensures that whether a customer begins onboarding on a mobile device, completes it in a branch, or resumes online, the experience is continuous, personalized, and channel-agnostic.

This composable model doesn’t just improve user experience, it changes how IT and business teams work together. Marketing teams can quickly introduce new onboarding campaigns or offers without requiring back-end changes. Compliance teams can integrate new verification providers or risk scoring models as regulations evolve. Developers can reuse APIs across multiple projects, reducing duplication and accelerating delivery.

For regional banks and credit unions, API-led connectivity makes it possible to combine best-in-class FinTech solutions, like Alloy for identity decisioning, Prove for phone-based verification, Mitek for document capture, Plaid for instant account verification, and Payroc for payments, into a single, seamless onboarding journey. All data flows through governed, reusable APIs, ensuring consistency, security, and regulatory compliance across the entire ecosystem.

The result is a truly integrated digital experience that feels effortless to the customer but is powered by a sophisticated, composable architecture beneath the surface. Onboarding becomes not a single application, but a connected ecosystem that evolves and scales to adopt new products, partners, and technologies as they emerge.

Leveraging API-led connectivity, financial institutions can now deploy new digital experiences in weeks instead of months, respond faster to regulatory changes, and deliver the seamless, real-time interactions that customers and members increasingly expect.

Implementing an API-Led Connectivity Strategy

For most financial institutions, adopting an API-led connectivity model begins with establishing a clear integration roadmap that aligns technology modernization with business priorities. The goal is not to replace existing systems overnight, but to create a structured pathway for innovation that builds on what already works.

The first step is assessment — understanding the current integration landscape, including how core, lending, onboarding, CRM, and compliance systems interact today. From there, IT and digital leaders can identify high-impact areas where reusable APIs will deliver immediate value — often starting with digital onboarding, loan origination, or digital banking enhancements.

Next comes architecture and enablement. Institutions should define the three API layers, System, Process, and Experience, and establish governance frameworks to manage authentication, authorization, and lifecycle management across all APIs. Selecting the right platform is key; we often recommend MuleSoft’s Anypoint Platform because it provides the centralized control, security, and monitoring tools needed to manage APIs across hybrid cloud and on-prem environments.

As institutions progress, the focus shifts to reusability and scale. Once core and onboarding systems are API-enabled, those same APIs can be extended to support new experiences, such as partner integrations, data sharing under open banking frameworks, or automation through RPA and AI-driven decisioning. Over time, the result is a composable, future-ready architecture that supports continuous innovation without disruption to core systems.

Getting Started

At Accutive FinTech, we specialize in helping banks and credit unions adopt and realize the full potential of API-led connectivity. Our team combines deep integration expertise with financial services domain knowledge to design, implement, and optimize integration strategies that balance speed, security, and scalability.

Our approach includes:

- Integration Strategy and Architecture: Designing API-led frameworks that align with your digital transformation roadmap.

- MuleSoft Implementation and Enablement: Building System, Process, and Experience APIs that connect your core, onboarding, and lending ecosystems.

- FinTech Ecosystem Integration: Seamlessly connecting best-in-class partners like Alloy, Prove, Mitek, Plaid, and Payroc through APIs.

- Managed FinTech Services: Providing ongoing monitoring, optimization, and support to ensure performance, compliance, and cost efficiency.

By partnering with Accutive FinTech, financial institutions gain more than technical integration expertise, we provide a team of FinTech experts that guide you along your digital transformation jounrey. Whether you’re modernizing your onboarding platform, connecting new FinTech partners, or preparing for open banking and real-time payments, we help you deliver secure, connected experiences that scale with your business.